All the facts and quotes are drawn from the four articles/reports linked at the bottom of this post:

"Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Fosun International Limited (HKG:656) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

See our latest analysis for Fosun International

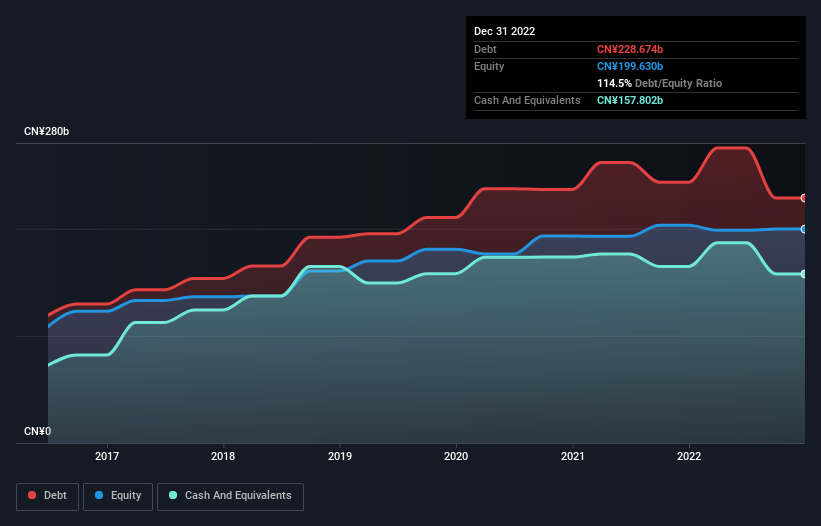

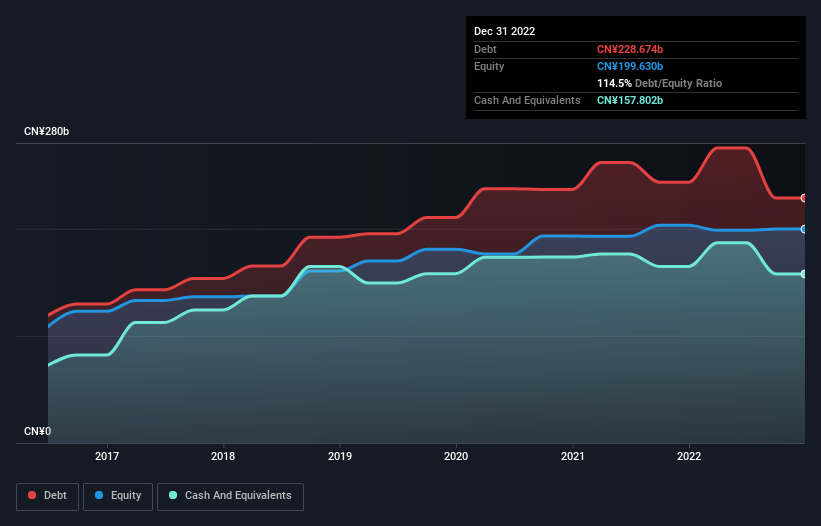

SEHK:656 Debt to Equity History May 6th 2023

SEHK:656 Debt to Equity History May 6th 2023

This deficit casts a shadow over the CN¥39.0b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Fosun International would likely require a major re-capitalisation if it had to pay its creditors today."

My emphasis. So far Fosun have stayed afloat simply by selling assets, which allowed for a small reduction in overall debt, and allowed for their credit rating to be moved up to "stable" from "negative" in the three quarters preceding the last financial report in the spring of this year. Their plan is to further reduce overall debt, by paying off bond maturities through further asset sales. Both Thomas Cook, acquired only a few years ago, and Club Med are being actively touted for sale, with heavy weights Rothschild trying to find a buyer. According to the S&P report, Fosun will continue to look to sell assests and concentrate on so-called core businesses. What is core and what is peripheral in terms of Fosun's portfolio is difficult to establish, as they are a corporate entity that has spread into many diverse areas. And after all it wasnt so long ago that Jeff Shi was reassuring us that Wolves were a "legacy" project, that Fosun were wholly commited to.

Debt and a lack of easily saleable assets is not Fosun's only pressing problem, however. In the last year's financial report, Fosun's earnings before interest and tax, (EBIT) reportedly ran at a loss, which, of course, puts the debt mountain into a different perspective. A company making good annual profits is putting debt to good use in turning a profit and growing the company. But the opposite holds true.

Generally the financial press/industry view Fosun pessimistically, (what Simply Wall Street call an intense disaffinity for Fosun stock), and their share price is at a five year low. Fosun however predict a near 50% rise in earnings for the current financial year, and look to further sell assets to reduce debt.

Are Wolves one of those assets? From all the above recently revealed financial figures, such a sale certainly cannot be ruled out.

Here are the articles to have a look at:

simplywall.st

simplywall.st

www.forbes.com

www.forbes.com

simplywall.st

simplywall.st

"Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Fosun International Limited (HKG:656) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.See our latest analysis for Fosun International

What Is Fosun International's Debt?

The image below, which you can click on for greater detail, shows that Fosun International had debt of CN¥228.7b at the end of December 2022, a reduction from CN¥243.4b over a year. However, because it has a cash reserve of CN¥157.8b, its net debt is less, at about CN¥70.9b. SEHK:656 Debt to Equity History May 6th 2023

SEHK:656 Debt to Equity History May 6th 2023How Strong Is Fosun International's Balance Sheet?

According to the last reported balance sheet, Fosun International had liabilities of CN¥372.4b due within 12 months, and liabilities of CN¥251.1b due beyond 12 months. Offsetting these obligations, it had cash of CN¥157.8b as well as receivables valued at CN¥62.5b due within 12 months. So its liabilities total CN¥403.2b more than the combination of its cash and short-term receivables.This deficit casts a shadow over the CN¥39.0b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Fosun International would likely require a major re-capitalisation if it had to pay its creditors today."

My emphasis. So far Fosun have stayed afloat simply by selling assets, which allowed for a small reduction in overall debt, and allowed for their credit rating to be moved up to "stable" from "negative" in the three quarters preceding the last financial report in the spring of this year. Their plan is to further reduce overall debt, by paying off bond maturities through further asset sales. Both Thomas Cook, acquired only a few years ago, and Club Med are being actively touted for sale, with heavy weights Rothschild trying to find a buyer. According to the S&P report, Fosun will continue to look to sell assests and concentrate on so-called core businesses. What is core and what is peripheral in terms of Fosun's portfolio is difficult to establish, as they are a corporate entity that has spread into many diverse areas. And after all it wasnt so long ago that Jeff Shi was reassuring us that Wolves were a "legacy" project, that Fosun were wholly commited to.

Debt and a lack of easily saleable assets is not Fosun's only pressing problem, however. In the last year's financial report, Fosun's earnings before interest and tax, (EBIT) reportedly ran at a loss, which, of course, puts the debt mountain into a different perspective. A company making good annual profits is putting debt to good use in turning a profit and growing the company. But the opposite holds true.

Generally the financial press/industry view Fosun pessimistically, (what Simply Wall Street call an intense disaffinity for Fosun stock), and their share price is at a five year low. Fosun however predict a near 50% rise in earnings for the current financial year, and look to further sell assets to reduce debt.

Are Wolves one of those assets? From all the above recently revealed financial figures, such a sale certainly cannot be ruled out.

Here are the articles to have a look at:

Is Fosun International (HKG:656) Using Debt Sensibly?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company...

China Billionaire’s Fosun Gets S&P Ratings Boost After Cutting Debt By $3 Billion; Stock Rises

Shanghai-based investment company's assets include Club Med

www.forbes.com

www.forbes.com

https://news.sky.com/story/chinese-...ital-goods/hkg-656/fosun-international-shares

Fosun International (SEHK:656) - Stock Price, News & Analysis - Simply Wall St

Research Fosun International's (SEHK:656) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more.